-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

*Dollar consolidates near key range amid investor indecision

*U.S. government shutdown weigh on sentiment

*Delayed U.S. economic data adds uncertainty to Fed outlook

Market Summary:

Crude oil prices extended their decline last week, tumbling to multi-month lows as growing fears over the glThe U.S. Dollar Index (DXY) traded in a narrow range this week, hovering near key technical levels as investors weighed conflicting market signals. Persistent uncertainty over the U.S. fiscal situation and global risk sentiment kept traders cautious, limiting directional conviction for the greenback.

Earlier concerns over U.S. dollar debasement, which had driven investors toward cryptocurrencies, have begun to ease following last weekend’s sharp crypto selloff. While digital assets rebounded modestly afterward, the volatility prompted investors to reassess the narrative around dollar weakness. The DXY regained modest demand, though its long-term outlook remains tilted to the downside.

The ongoing U.S. government shutdown, now among the longest on record, has delayed the release of key economic indicators — including Nonfarm Payrolls and Unemployment Rate data. The absence of fresh economic figures has complicated the Federal Reserve’s policy assessment, while rate-cut expectations continue to linger, keeping medium-term pressure on the dollar.

On the supportive side, heightened U.S.–China trade tensions and political uncertainty in France have encouraged safe-haven demand for the dollar, cushioning its losses. Moving forward, traders will closely monitor developments surrounding the U.S. fiscal impasse and U.S.–China relations, both of which could dictate near-term direction for the greenback.

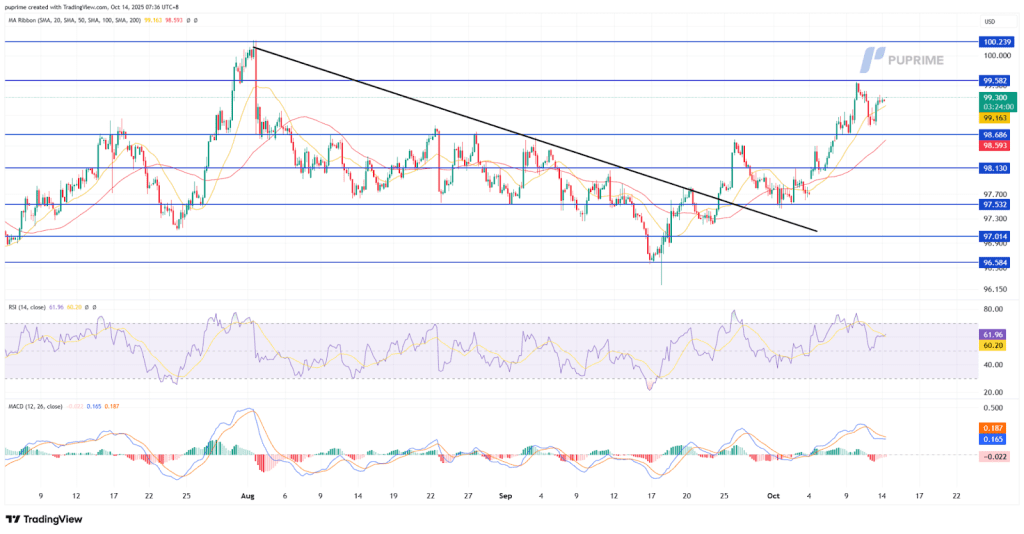

Technical Analysis

The Dollar Index is trading lower and currently testing the support level at 98.80, forming a potential double-top pattern. The MACD shows increasing bearish momentum, while the RSI has broken below the midline, standing near 43, suggesting a bias toward further downside.

A confirmed break below 98.80 could open the door for a move toward the next support at 98.15. However, if the index holds above this level, a rebound toward 99.55 remains possible.

Resistance Levels: 99.55, 100.25

Support Levels: 98.80, 98.15

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!