-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

*Yen rebounds after sharp losses as safe-haven demand returns

*Finance Minister Kato signals possible intervention to curb excessive weakness

*Market volatility rises amid Trump’s new tariff threats on China

Market Summary:

The Japanese yen recovered late last week after suffering a sharp drop earlier, as renewed market tensions spurred safe-haven demand for the currency. Despite the rebound, the yen’s broader trend remains weak amid expectations that Japan’s new government will adopt a more expansionary fiscal and monetary stance to stimulate the economy — a policy mix that could weigh further on the yen through increased money supply and inflation pressure.

The currency stabilized after Finance Minister Katsunobu Kato warned that authorities may consider intervention measures if excessive currency weakness persists. His comments provided temporary relief to the yen, helping it claw back some of its earlier losses.

However, global sentiment turned fragile over the weekend as former U.S. President Donald Trump vowed to impose aggressive tariffs on Chinese imports, heightening tensions between the world’s two largest economies. The move sparked a broad market selloff across equities and cryptocurrencies, reviving risk aversion.

With the dollar retreating on renewed safe-haven flows, investors turned back to the yen as a defensive play, helping the currency stabilize heading into the new week.

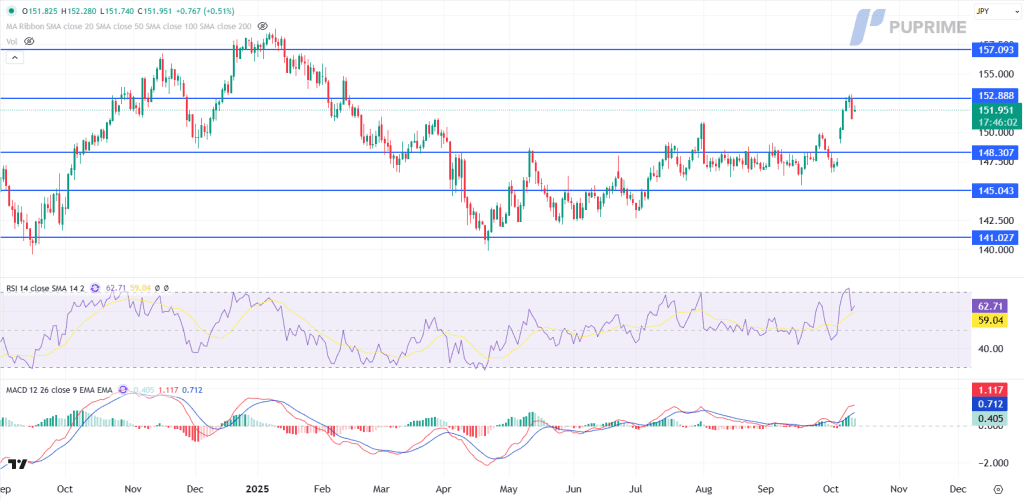

The pair remains in a broader uptrend but is currently consolidating near the strong resistance level of 152.90. A bearish engulfing pattern has formed, suggesting potential for near-term downside. Should bearish momentum persist, the pair may retest the next support at 148.30.

Momentum indicators reflect growing downside risk — the MACD shows diminishing bullish momentum, while the RSI has retreated sharply from overbought territory to 63, signaling potential for extended losses.

However, if fundamentals turn in favor of dollar strength and the pair breaks decisively above 152.90, the next upside target could be 157.10.

Resistance Levels: 152.90, 157.10

Support Levels: 148.30, 145.05

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!